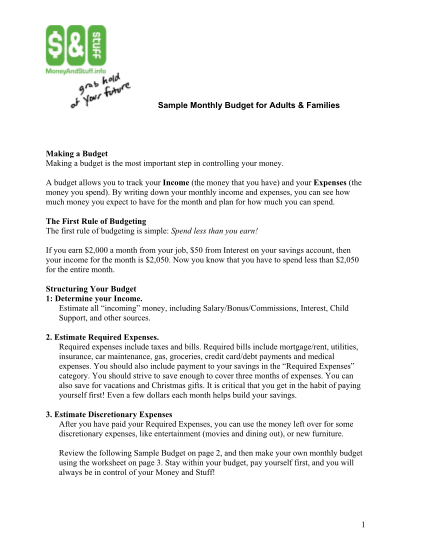

Goodbudget is a personal finance app perfect for budget planning, debt tracking, and money management. Share a budget with sync across multiple phones (and the web!). MANAGE MONEY WITH PEOPLE YOU LOVE Goodbudget is perfect for sharing a budget with a spouse, family member, or friend. It works well for college students who want to budget money easily, parents who want to control the household expenses with the printable family budget template and creatives and professionals who need a budgeting tool that can also be used as a wedding budget or event budget template. Download free budget template now and print it at office.

Kimberly Steinhoff December 4, 2019 FamilyBudget

Precautions need to be taken for budgeting on an irregular income. Budgets with irregular income should keep two things in mind: spending more than your average income, and running out of money even when your income is on average.

Tips for Budgeting Success. Once you have taken the time to create a budget its time to follow it. You can have the best of intentions of following a budget, but after a few weeks or months you drift away from your plan. Do not let that happen to you. Here are a few basic tips that will ensure your budget is a success.

So how exactly does one create a budget? There are many ways, but the best, fastest, and easiest way to make a budget is to buy a good family budget software program. A large number of families fail to make a budget simply because they feel that the concept of budgeting is too hard, however, this could be further from the truth with good software.

One of the greatest and most essential aspect of balancing your budget is bringing together any high interest debts repayments which you may have currently. This will potentially save you plenty of dollars in interest repayments alone, as well as the strain of having these debts constantly hanging over you and your family`s head. Debt consolidation is an essential item which you are able to easily do yourself if you are economically clever, alternatively you might just have the inclination to recruit the resources of a specialist business to assist you with this extremely critical task.

Free Weekly Budget Template Downloads

Budget for Two Person Household

Sep 15, 2020Detailed Household Budget Worksheet

Sep 22, 2020Basic Monthly Budget Household Expenses List

Sep 09, 2020Xls Family Budget Template Excel

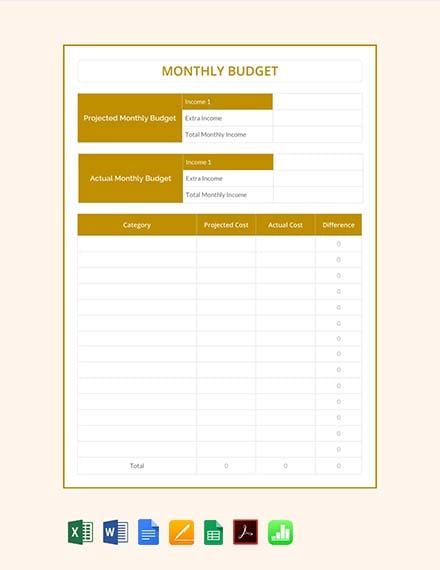

Dec 09, 2019A budget needs to estimate your average (yearly) income. Spending, which will be relatively constant, needs to be maintained below that amount. A budget should allow for error and so keeping expenses 5% or 10% below the estimated income is a conservative approach. When done correctly, your budget should end any given year with about 5% of their income left over. Of course being conservative and having more than 5% is never a bad idea.

Setting up your financial budget as a joint venture for the whole family can be a fulfilling and satisfying experience. If you have not had success with managing your finances in the past, then setting up a budget will put your economic situation into perspective and serve several purposes all at once, helping you to make cuts in the spending habits that went un-noticed previously. Getting your specified budget down on paper can be boring at first - but once you master the art, you may find that you will enjoy the challenge and rewards of sticking to your budget.

Photos of Family Budget Planner For Mac Free

RELATED ARTICLES

Monthly Household Budget Form

Oct 10, 2020Family Budget Template Doc

Dec 07, 2019